Attitude-Behavior Gap Report

Attitude-Behavior Gap Report

How the industry and consumers can close the sustainability Attitude-Behavior Gap in fashion

How the industry and consumers can close the sustainability Attitude-Behavior Gap in fashion

Dear readers,

The coronavirus crisis will go down as one of the most challenging times in recent history, both in terms of the humanitarian impact and its economic consequences. Amid lockdowns in almost every country, we have all been required to come to terms with new ways of living and working, and many things we previously took for granted have changed.

Introduction

In this tumultuous time, sustainability is a powerful imperative. However, the world of fashion is often unclear about how to implement sustainability at scale. Companies face strategic and operational barriers, and consumers struggle to turn their sustainability goals into reality. Despite good intentions, just 20% of people actively compare brands’ sustainability credentials when they are shopping, research for this paper shows, and there is a gap between attitudes and behaviors across a range of dimensions.1

As the industry and its customers grapple with the sustainability challenge, the world is changing faster than anyone could have expected. The coronavirus outbreak is impacting lives and livelihoods, and there is a sense of evolution in the way we see our world and operate within it. Two-thirds of consumers state that sustainability has become a more important priority for them since the start of the outbreak.2 At the same time, the fashion industry faces an economic challenge. Economic profit fell by around 93% in 2020, after rising 4% in 2019.3 European fashion revenues shrunk by almost 19% in 2020, amid sliding demand across segments and geographies.4 Companies leveraging digital have tended to perform better, but the aggregate picture is bleak, both among brands and in the supply chain.

1 Zalando consumer survey: For details, see chapter: Methodology

2 CEO Agenda 2020 – COVID 19 Edition, GFA, May 2020.

3 McKinsey Global Fashion Index, analysis of 326 listed companies, McKinsey & Company, August 2020.

4 Euromonitor, Europe excl. Russia, January 2021.

Still, the picture is not uniformly negative, and there are signs that a more positive future can emerge from the pandemic. With many stores shut, and demand remaining subdued, decision makers have had a chance to step back and review plans for the future. Given rising consumer appetite for sustainable products and services, many companies are adapting their business models and preparing to emerge from the crisis stronger.

The good news for the industry is that consumers do not demand perfection. Above all, they want to be able to trust brands and know where brands are on their sustainability journeys. To avoid the perception of greenwashing, brands should quantify their impact wherever possible. Consumers feel that these kinds of steps can take the pressure off them. Equally, they would like more information about which brands are not living up to the standards they expect.

Our analysis focuses initially on the attitude-behavior gap and discusses seven key themes — the underlying reasons for the gap. We follow up with actionable recommendations, aiming to inspire industry participants and consumers to close the gap between attitudes and behaviors and move forward on the sustainability agenda.

Methodology

This report explores the gap between consumers’ sustainability attitudes and behaviors.5 To inform our work, we conducted a deep ethnographic study with 12 Zalando customers from Germany, Sweden and England. The results of this work informed our consumer survey, in which we interviewed 2,500 consumers in the United Kingdom, Sweden, Italy, France and Germany to better understand why many struggle to translate their sustainability beliefs into actions. Armed with the results of these efforts, we reached out to our industry colleagues and assembled their ideas on how the industry can promote sustainability and enable consumers to make more sustainable decisions.

5 In this report, “consumers” refers to survey respondents, while “customers” refers to customers of the businesses mentioned.

Ethnography

We started by immersing ourselves in the lives of our 12 customers, aiming to find out what was stopping them from acting sustainably. The group (Emma, Christian, Anita, Matilda, Marcus, Raine, Saskia, Christofer, Finbar, Maximilian, Deborah and Egor, see Appendix) ranged in age from 22 to 34 and represented a variety of demographics and attitudes.

Some described themselves as “fashion obsessed” while others had different priorities. Over a number of weeks before the coronavirus outbreak, we held informal discussions in their homes and offices, focusing on their attitudes toward fashion and their influences — how they shop, why they shop, and their feelings about sustainability.

Once we had completed the interviews, we went shopping with our participants, observing their habits, decision-making processes and the triggers. To see if they put their words into actions, we explored their wardrobes. Here we tested the dynamics underlying the information we had gathered. Finally, we probed deeper into our participants’ relationships with sustainability and brands. We explored the effectiveness of language and tone in shaping purchasing decisions and identified major enablers and inhibitors. The individual views of our core group are quoted throughout this report.

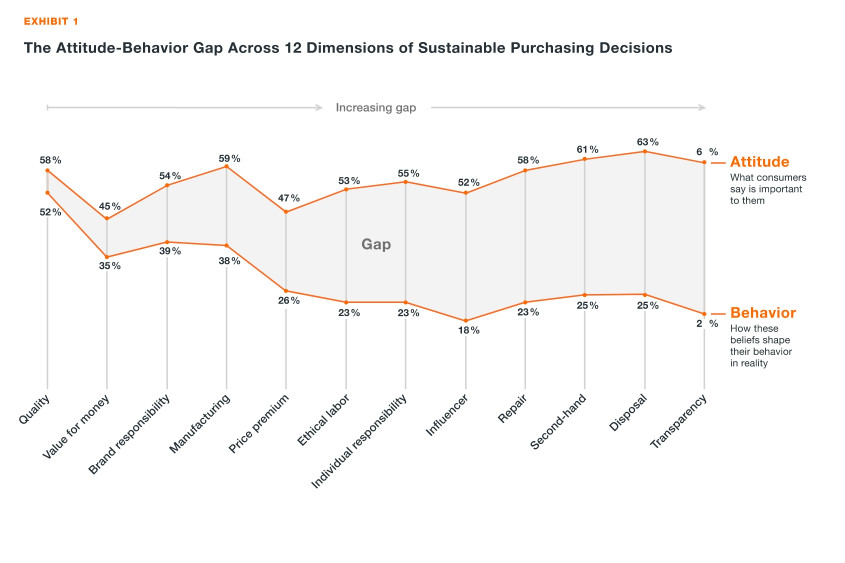

The results of our research enabled us to identify 12 dimensions that play a role in attitudes toward sustainability and fashion. These comprise quality, value for money, brand responsibility, manufacturing, price premium, ethical labor, individual responsibility, influencers, repair, second- hand, disposal and transparency.

Survey

Based on the 12 dimensions, we surveyed 2,500 people in the United Kingdom, Sweden, Italy, France and Germany. We spoke to a range of consumers who were interested in both sustainability and fashion:

- 50% were Gen Z (aged 18–24) and 50% were Millennials (aged 25–35)

- 50% identified as sustainable consumers and 50% were actively engaged in fashion

- They were equally split between male and female

- Their education and income profiles varied

We asked two questions in relation to each of the 12 dimensions: “How important is this dimension to you when buying fashion?” and “How often do you do the following — for example, check an item’s origin?” The replies we received demonstrated the substantial gaps between attitudes and behaviors, and these directly informed our analysis and our recommendations.

Finally, we sense-checked our findings with our industry partners and incorporated their views into our results. We also conducted a separate analysis focused on the direct impacts of the pandemic (see How the Coronavirus Crisis Is Shifting Behaviors).

Exploring the Attitude-Behavior Gap

An attitude-behavior gap in relation to sustainability and labor conditions refers to a situation in which “individuals exhibit positive attitudes but fail to execute on these attitudes by engaging in responsible behaviors.”6 Here we explore the characteristics of the gap across 12 key sustainability dimensions.

The results of our survey show that the gap varies depending on the dimension (Exhibit 1). In respect of quality and value for money, for example, it is relatively narrow. Some 58% of consumers in our survey view long-lasting quality as important, and 52% say they often shop with this in mind. Similarly, 45% prioritize value for money, and 35% say they regularly choose a deal over a sustainable item.

Other times, the gap is wide. Some 60% of survey respondents say that transparency is important to them, but just 20% actively seek out information as part of the purchasing process. Some 53% believe it is important to buy from brands with ethical labor policies, but only 23% ever investigate policies themselves. (We recognize that there is a tendency to over-report socially desirable sentiments, which may impact some of our survey responses.) Similarly, 58% of consumers believe they should understand the product, including the materials used. However, just 38% regularly check the label for information.

6 The Attitude-Behavior Gap in Environmental Consumerism, Shruti Gupta, Pennsylvania State University/Abington, and Denise T. Ogden, Pennsylvania State University/Lehigh Valley, 2006.

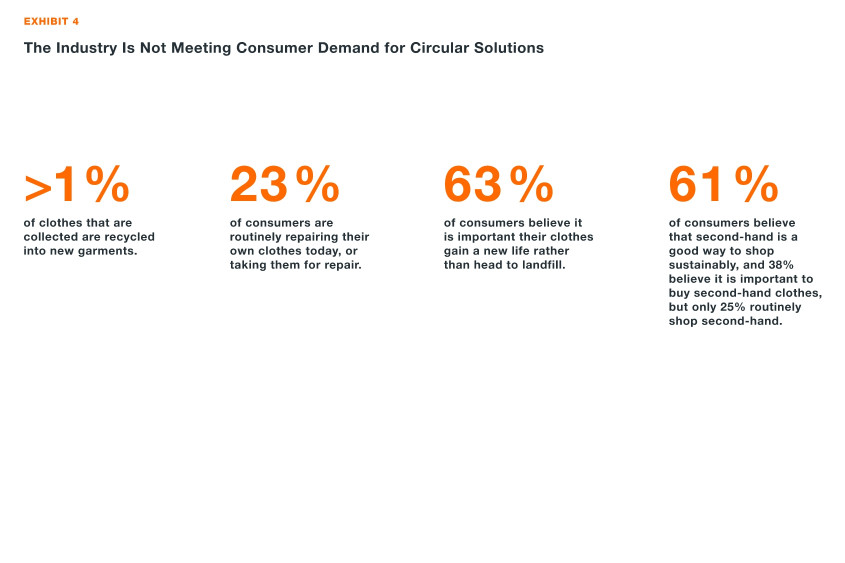

Around 60% of consumers say repair, second-hand and sustainable disposal are important to them. Still, few have embraced the circularity concept. Just 23% repair their own clothes and only 25% regularly buy second-hand. A similar proportion pass clothes on rather than throwing them away.

Our survey reveals that consumers expect the industry to help them do more in these endeavors. Over half think it is important for brands, online platforms and vendors to take the pressure off them by taking steps toward sustainability. However, consumers also want to feel they can play a useful role. Some 58% say it is important for them personally to have an impact on fashion sustainability. As the title of this report suggests, It Takes Two. When it comes to making change happen, the industry and consumers must work together.

Consumer Attitudes: Seven Key Themes

The responses we received to our survey and ethnographic study reveal a variety of attitudes and opinions. However, seven key themes encapsulate how consumers feel about sustainability in fashion.

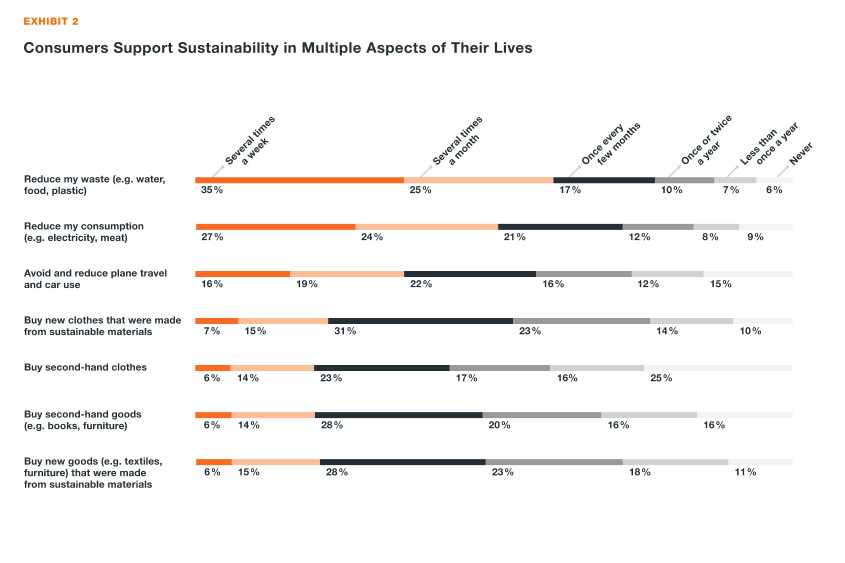

Theme 1. Consumers Care a Lot About Sustainability — but Less About Sustainable Fashion

Two in three consumers say sustainability is important in their daily lives. Indeed, half are taking steps toward reducing waste and consumption in general (Exhibit 2). Sustainability at home is more prominent in consumers’ minds than sustainable fashion. For example, some 72% say it is important to reduce food, plastic and water waste, but only 54% say the same about fashion. Just 38% prioritize second-hand fashion.

One reason for the gap between daily attitudes and fashion attitudes is that fashion commands a special place in people’s lives. Some 65% of women and 56% of men feel their self-confidence is “strongly influenced” by the clothes they wear. Indeed, many fashion consumers associate fashion with self-expression — they want to consume the fashion they enjoy. Conversely, when it comes to sustainable fashion, the most common sentiment is guilt, and half of consumers are not even sure what sustainability in the context of fashion means. Furthermore, 44% feel sustainable choices in other parts of their lives compensate for less sustainable choices in fashion.

Still, many consumers are making an effort. Some 56% would be prepared to make some sacrifices to be more sustainable — although they would not change how they shop entirely.

I know I’m a bit of a hypocrite with my fashion actions, but I don’t want to feel guilty when I’m trying my best. I don’t fly anymore, but fashion is my one escape — it’s ‘me time’.

Emma, 33, Stockholm, SE

(ethnographic study participant)7

7 Quotes by ethnographic study participants are tagged with the participant’s first name.

Theme 2. Sustainability Still Comes After Value, Quality and Fit

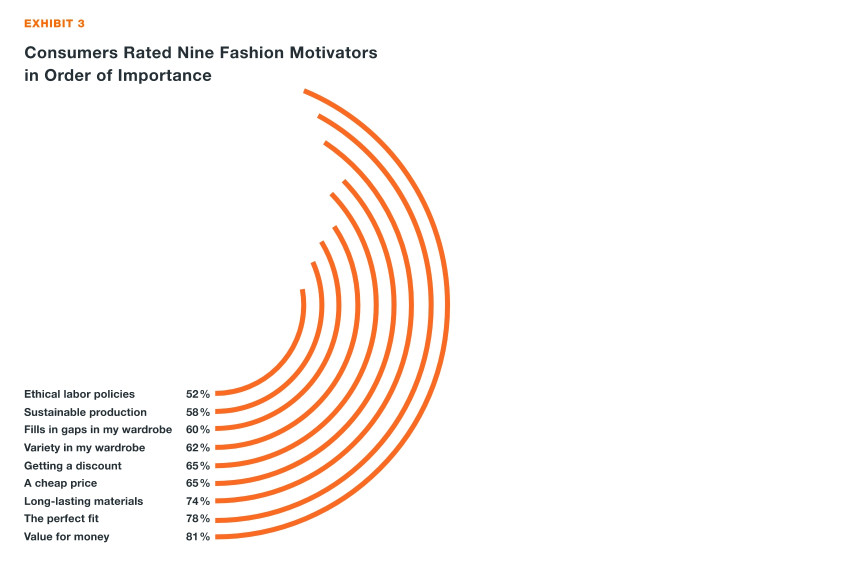

When asked about their fashion purchasing decisions, just 52% and 58% of consumers, respectively, mention sustainable production and ethical labor policies (Exhibit 3). Conversely, some 81% say value for money is their priority and 78% focus on the perfect fit. We recognize that these requirements are unlikely ever to be anything other than primary. However, it may be possible to narrow the gap between the baseline focus on value and fit and sustainability considerations.

If something fits right, that’s the most important thing for me. I’m not buying something because half of the profits will go to the environment. It just doesn’t convince me.

Christian, 30, Hamburg, DE

Drilling down into individual behaviors, just 38% of people buy fashion based on the sustainability of production processes, and just 23% do so because of the brand’s labor policy. Some 41% believe fashion shopping is “already enough of a chore,” without having to think about sustainability.

Some 74% of consumers say that picking clothes made of durable materials is important, but few are confident they can make a judgement on how long any item will last. Only 38% regularly check the label for information. For most, the baseline quality of high-street fashion is perceived as being too low, with many consumers reporting faulty or damaged items after minimal wear. This is cited as evidence of declining quality across both fast-fashion and luxury brands and may be a barrier to circularity that the industry needs to address.

Theme 3. Discounts Can Lead to Overconsumption, Which in Turn Creates Buyer’s Regret

The satisfaction of finding a bargain can be intense, but when the joy is short-lived it can lead to compulsive purchases and overconsumption. For some of our participants, the allure of a bargain is so strong that if they do not get a deal, they feel they have been unsuccessful. Some 65% of consumers say they are looking for a low price and/or discount when buying clothes.

Some 52% of females and 46% of males say the “thrill of the purchase” is important or very important. This suggests that a common pattern of behavior may be for consumers to focus primarily on deals and end up buying more than they intended.

Many consumers understand that impulsive, bargain-seeking behavior does not sit well with their sustainability beliefs. When the initial excitement of purchase has abated, there is often a sense of regret. Some 82% say they have felt some form of regret after shopping, with 28% of that group concerned about the impact on the planet and considerations such as the conditions in which the product was made. Notably, discounting can cut both ways. While 35% state that a deal may inhibit sustainable purchases, some 54% say that a rewards scheme would encourage them to purchase more sustainable fashion. The enthusiasm for rewards may indicate that consumers are looking to brands to help them make a more positive impact.

Theme 4. Many Influencers Are Not Seen as Credible on Sustainability Issues

Most consumers are skeptical about the role that influencers play in discussing sustainability issues. Still, some 52% believe it is important for someone to show them how to be more sustainable. The message, therefore, is that if influencers promote sustainability, they must first establish their credibility.

A challenge for the industry is that there is no single voice of authority for “sustainable fashion.” Some consumers in our survey cite the absence of a fashion “leader” in the mold of Swedish activist Greta Thunberg. Still, while nearly half of consumers would be open to getting sustainable fashion advice from a credible influencer, only 18% believe it would enable them to shop sustainably.

Reflecting the lack of trust in influencers, many consumers say their friends and family are more likely to encourage and inspire behavior change. Indeed, some 35% turn to friends and family for advice, while 38% say social media is their biggest influence. This suggests that, despite the challenges, there is a common desire for more guidance on sustainability issues.

Obviously, we have Greta, but I think we’re still missing a role model in the fashion industry.

Deborah, 24, Lund, SE

Theme 5. At the “End” of Product Life, Consumers Cannot Reflect Their Values

Less than 1% of material in clothing is recycled into new garments.8 In addition, consumers miss out on $460 billion of value each year by throwing away clothes; it is common for garments to be discarded after just seven to ten wears.9 Still, consumers want to pass on clothes, whether by donating, trading or selling, and 63% believe it is important their clothes get a new lease of life rather than heading to landfill.

Some of the industry’s leading players have started to move beyond the current take-make-dispose model, launching schemes to keep products and materials in use and design waste out of the system. Recycling, take-back and resale offers are increasingly common in stores and online. In general, female consumers view passing on clothes as more important (69%) than males (55%). However, consumers feel that the industry could do more to facilitate initiatives, and 51% believe it would help them act more sustainably if brands bought clothes back from them.

8 A New Textiles Economy, Ellen MacArthur Foundation, 2017.

9 Fashion and the Circular Economy, Ellen MacArthur Foundation, 2017.

Brands need to make bigger operational and system changes, which we aren’t capable of as customers. It’s easy for me to dispose, and I do it, but I’m sure there’s more I could do.

Christofer, 33, Lund, SE

Theme 6. Second-Hand Picking Up Momentum but Still Under-Appreciated

Some 61% of consumers believe that buying second-hand clothes is a great way to shop sustainably. 49% of customers believe brands offering a second-hand section or outlet would help them act more sustainably. But only 25% of the group actually buy second-hand clothes on a regular basis. Sweden (27%) and France (30%) lead the way.

Many are citing concerns over hygiene and a lack of convenient options, with hygiene being an even bigger issue among men (43%) than women (30%).10

If it’s a dress, I’ll always Depop it. One girl’s trash is another girl’s treasure!

Saskia, 22, Manchester, UK

Where consumers buy second-hand, digital channels are a key enabler, alongside local second-hand shops and flea markets. We estimate the global second-hand market will grow by 15 to 20% per year over the next five years. Some online second-hand players in developed markets could even double their annual growth.11

10 Zalando’s Buzz Survey Pre-Owned Fashion, 2,727 Zalando customers in Germany, Q4 2019.

11 The Consumers Behind Fashion’s Growing Second-hand Market, Boston Consulting Group, October 2020.

Theme 7. Consumers Want to Keep Clothes for Longer but Lack Knowledge on Care and Repair

The input we received for our ethnographic study suggests consumers are increasingly focused on repairing and mending.

I never learned how to sew in school, but I’m glad I took the time to teach myself.

Matilda, 24, Hamburg, DE

That sentiment is echoed in our consumer survey, in which some 58% of respondents say they think it is important to repair clothing, particularly when it comes to high-value or favorite items.

Still, the attitude-behavior gap is substantial — just 23% of consumers routinely repair their clothes or take them for repair. A commonly cited reason is a lack of knowledge, and consumers often fall back on friends or relatives. In many cases, they would like to see brands doing more to help. One in two consumers believe that if brands and retailers offered mending services, they would be able to act more sustainably.

How the Coronavirus Crisis Is Shifting Behaviors

The coronavirus pandemic is first and foremost a humanitarian crisis. However, it is also having a significant impact on the global economy and consumer behaviors. Perhaps the most significant change is that it has highlighted the fragility of human and planetary ecosystems, and shown how important it is for humans to live in harmony with their environment. As a result of the crisis, two-thirds of consumers say it has become even more important to limit climate change, and around 90% believe pollution should be reduced as a priority.12 At a macro level, we also see this behavior change among Zalando customers. The share of active customers buying more sustainable items more than doubled to 50% between January and December 2020. Our sustainable assortment also tripled over the same period, suggesting this also may have been a factor in purchasing decisions.13

The pandemic has had a significant impact on people’s confidence, job security and earnings. As a result, people are even more concerned about the value, price and longevity of their clothes. Some 71% have invested in higher-quality garments during the outbreak, despite a widespread increase in price sensitivity.14 15 In addition, consumers have been more focused on disposals — two in five people have had a “clear-out” during the pandemic, with two in three giving unwanted clothes to charity. In one positive trend, the proportion of people actively committed to stopping clothing waste rose to 50% in 2020, from 31% in 2017.16 Indeed, Zalando customers sold more than 100,000 items to the business within just one month of the launch of our “Pre-owned” category.

Still, the industry has found that old habits die hard. Some 60% of respondents to one industry survey say they had implemented more discounting as a result of the coronavirus outbreak, amid high levels of overstocking, and 70% expect to do more discounting.17 Around 60% of retailers describe their current level of discounting as “unsustainable.”

12 It’s time to rewire the fashion system: State of Fashion coronavirus update, McKinsey & Company, April 2020.

13 Zalando Sustainability Progress Report, corporate.zalando.com, Zalando, March 2020.

14 It’s time to rewire the fashion system: State of Fashion coronavirus update, McKinsey & Company, April 2020.

15 Internal Zalando COVID-19 Research Survey, 5,119 participants (662 Zalando customers) in Germany, France, Italy, Spain and Sweden, Zalando, April 2020.

16 Citizens and clothing behaviours during lockdown, WRAP, June 2020.

17 Drapers Investigates: the impact of promotions in a pandemic, Drapers, June 2020.

There are other, more subtle changes in progress. Some 34% of 18- to 34-year-olds say they now watch more influencer content during and because of the pandemic. Having said that, 82% of the same group report they have a lower tolerance for regular advertising.18

In the early days of the pandemic, there was a backlash against “showing off” and lavish lifestyles. Instead, there was a desire for authenticity, and trust has emerged as a critical theme — 70% of consumers said in May 2020 they expected to stick with brands they trusted during the crisis.19

18 Brands Look Beyond COVID-19 For Role Of Social Media Influencers (Fullscreen study), Forbes, June 2020.

19 Updated Sustainability Agenda to Guide Fashion Leaders Through COVID-19 Crisis, GFA CEO Agenda, May 2020.

Closing the Gap: 10 Recommendations for the Industry

Fashion companies have an opportunity to close the attitude-behavior gap through their own operations and by working with consumers. We believe we can motivate changes in behavior, communicate more effectively and work to scale circularity. Together with our partners, we have developed 10 recommendations to support the industry in closing the gap. We offer four solutions that may help companies kick-start their journey, and six more for companies that are ready to accelerate their efforts.

Lay the Foundations

Recommendation 1. Take Steps Toward Transparency and Bring Your Customers on the Journey

Boost transparency by sharing supply chain information with your customers and/or publishing photos of supplier factories on your website. Move toward being open about your impacts and progress.

View transparency as a creative opportunity. Share stories that go deeper into your production processes and show how you are becoming more sustainable throughout the value chain. Spotlight production visits or audits, product design processes and sustainability partnerships. Be humble and do not overclaim your progress.

“One example is our H&M Group brand Monki, where our colleagues want to have an open dialogue with their community. By collecting common questions via social media, they are able to address how they work with sustainability throughout the supply chain, production, people in factories and living wages, but also how they are thinking ahead, what they dream to do and change and how they believe in a different fashion industry in the future.”

Hanna Hallin, Global Sustainability Manager, Treadler (H&M Group)

Recommendation 2. Speak a Sustainability Language That Everyone Can Understand

Work with the Sustainable Apparel Coalition and Higg Index tools to create industry-wide sustainability standards, based on a common language, and leveraging data from brands, retailers and factories. Ensure that the language used is easy for customers to understand and consistent across the industry.

“Brands must communicate their sustainability efforts in a way that both resonates with consumer values and is concise, comparable, and verifiable. Clear graphics and language are key to answer questions such as what steps is the brand taking to improve social and environmental performance? How does the company’s performance this year compare to that of last year? Where is it heading in its sustainability journey? Brands can communicate this journey to consumers and stakeholders using standardized and trusted Higg Index data. They can also expand the narrative across their consumer-facing channels, including product pages, social media, websites and advertising.”

Amina Razvi, Executive Director, Sustainable Apparel Coalition

Make standardized and trusted sustainability information available to consumers in an easy to understand and relatable way:

Recommendation 3. Help Your Customers Buy into Your Sustainability Brand Mission

Identify and invest in the changes that will make the biggest impact for your business and on your customers. Would cutting back on plastics make an impression, or should you focus on circularity? When you have identified your mission, tell your customers about it at suitable touchpoints on their journeys.

Recommendation 4. Help Your Customers Buy Right, Not More

Create awareness around more sustainable products and choices, and the benefits that these bring. When communicating with your customers, take the product life-cycle into account, so they can understand the range of sustainable options available at every stage.

Accelerate Change

Recommendation 5. Use Data and Technology to Fix Unsustainable Discounting

Tackle overstocking and unlock efficiencies through better planning and streamlined operational capabilities. Begin by optimizing your operations with smart planning and digital systems. Invest in machine learning and AI to improve your forecasting. Go one step further by exploring new business models, such as on-demand production capabilities.

Recommendation 6. Boost Conversion on Sustainable Products with Motivating Factors Such as Quality and Fit

Since value, quality and fit trump sustainability as motivators, use smart merchandising to position sustainable products around these benefits. For instance, highlight the quality benefits of organic cotton and communicate “cost-per-wear” to show value for money. Present products as investments that will stand the test of time.

Recommendation 7. Influence Wisely, Balancing Social Voices With Those of Your Customers and Employees

Balance social voices and give your customers credible role models by showcasing the sustainability journeys of relatable people. Use micro-influencers, or let your employees and customers shine in your marketing campaigns. Seek out new levers that may help convey messaging — leverage your advertising program, stand up for topics that your customers care about, and align your communication strategy with your brand values.

Recommendation 8. Integrate Circularity Throughout the Product Life-Cycle

Upskill your team in circular design, combat the challenge of overstocking, and pilot and test new business models such as resale or rental. Review the impact of your take-back schemes and reference learnings to scale your programs. Find out what the industry is doing to make fashion circular here.

Recommendation 9. Invest in Second-Hand

Fight the second-hand stigma by showcasing new and second-hand together in marketing campaigns, retail environments and on social media. Add second-hand schemes in-store and online, or partner with resale specialists. Help your customers see that second-hand is as good as new.

“There are stats out there showing how the second-hand market will overtake fast fashion in the next decade — we know that increasing the longevity of our clothes is key to outweighing the impact of their production.”

Jodi Everding, Fabric, Trim & Sustainability Manager, Filippa K

Recommendation 10. Help Your Customers Care for and Repair Their Clothes

Stay in contact with your customers on after-purchase care. Provide care instructions, for example on how to wash or store garments to ensure that they last. This will both help your customers care for their clothes and foster engagement and loyalty. In addition, by providing information after purchase, you give your customers a reason to get back in touch. Finally, when your customers love specific items, there is an impetus to connect with the brand over a longer period of time.

We recommend that fashion companies use stores to host events at which customers can learn how to repair. They should also make it easier for customers to find repair shops or tailors close by, for example by creating a directory of recommended partners.

Consumer Inspiration

Industry sustainability initiatives mean little without the support, enthusiasm and desire of consumers. Many have already started to adjust their behaviors and are reflecting their values in the fashion choices they make.

Below, we present some ideas that echo industry initiatives and may provide inspiration for further conversations and debate.

Be Mindful of Overconsumption

Try to make more conscious decisions. When you are tempted by a sale, pause at the checkout and ask yourself: “Can I see myself wearing this item more than 30 times next year?” Work with your wish list so you can better assess what is really missing in your wardrobe.

Your Voice Matters — Join the Conversation

Share the steps you are taking to make your fashion choices more sustainable and inspire others to follow your lead. Post your progress on social media, have conversations with friends and ask brands what they are doing.

Understand Your Shopping Impact

While sustainability might seem complicated, it does not have to be. There are tools that can help you understand the environmental impact you have when buying products, taking care and disposing of them later. To do this, check out the carbon dioxide footprint calculator. You can also decide on a cause that matters most to you when shopping. Zalando now explains the area of positive impact for more sustainable products.

Get Savvy on Sustainability

We cannot solve problems unless we understand them. Learn commonly used terms to identify sustainable products and brands. Broaden your knowledge here.

Get to Know Your Favorite Brands

Find out which fashion brands are leading the way on transparency. Have a look at the Fashion Revolution’s Fashion Transparency Index. Ask brands what actions they are taking on sustainability and inspire them to do more.

Parting with Fashion? Make Sure to Give It a New Life

The longer clothes stay in the value chain, the better. If you cannot or do not want to resell, try a collection program operated by one of your favorite brands, or host a “swap shop” with friends. You can also find your local donation option and double-check the clothes are going to a good cause.

Include Second-Hand Items in Your Wardrobe

As you consider what is missing from your wardrobe, challenge yourself to fill the gaps with second-hand items.

Learn About Caring for Your Clothes

There is so much you can do to extend the life of your clothing, which can be as simple as changing how you wash clothes. Wash less frequently and at lower temperatures, which will not only save energy but keep fibers fresher for longer. Sometimes, there are alternatives to washing, like airing or freezing. Check out how to take care of your clothes here.

Love Your Clothes Longer — Embrace Repair!

Learn these three repair basics: How to hem, how to sew a button, and how to patch up a hole. If you cannot do it yourself, hand your item over to a local professional. Find your nearest repair shop here.

In order to better understand our European consumers and their behavior, we visited some of them at their homes to talk about how they think and act in regard to sustainable fashion in their daily lives. Christofer, Isabel, Jannan and Sabrina showed us their wardrobes and shared how they shop, why they shop, and what they expect from fashion brands. Click on their profiles below to watch the videos and get to know them.

Conclusion

In a year that few people will forget, there have been changes that were unimaginable just a short time ago. As we adjust to a world impacted by the pandemic, the challenges we face have been cast into sharp relief. For many fashion consumers, social injustice and unsustainable ways of living and working are challenges that must be addressed without delay.

The research in this report highlights the fact that consumers care about the materials their clothes are made of, the labor practices associated with production, and what happens when they have finished with items. They cared before the pandemic and they have been caring more since the pandemic, as it has highlighted how human activities can spark destructive natural phenomena. There is momentum to build back better after the crisis, but the industry needs to provide encouragement and support to shift behaviors.

The 10 recommendations for the industry presented here encompass three broad themes — motivating changes in behavior, communicating with conviction, and scaling circularity. Each will play a critical role in moving the industry toward a more sustainable business model. Still, the recommendations are not a blueprint or set of commandments. We understand that individual companies and consumers face complex situations, none of which are easily translatable into a bolt-on solution. The imperative, therefore, is not the destination. Rather, it is the journey, which means that fashion companies must act and be seen to be doing so.

From our side, we would like to engage in conversation and debate, and collaborate with our peers so that the industry as a whole can work more effectively on sustainability. We want to walk the talk on It Takes Two, and we believe that now is the time for bold actions that will make a difference.

Appendix

The 12 consumers who took part in our ethnographic study played a significant role in helping this report become a reality. They are:

Saskia, 22, Manchester, UK

Saskia adores fast fashion and shops for clothes once or twice a week, rarely wearing the same outfit more than a couple of times. She is drawn to clothes that cost under £35, which she admits to finding “guilt-inducing” at times.

Anita, 33, Berlin, DE

Anita loves vintage fashion and second-hand shopping. She avoids fast-fashion brands but would not class herself as “sustainable.”

Christian, 30, Hamburg, DE

Fashion-obsessed Christian does not like wearing something he has had for longer than six months. He shops often and never worries about the price tag.

Christofer, 33, Lund, SE

Christofer considers all aspects of purchase rationally rather than emotionally (unless there is a sale). He is cynical toward any brand claiming they are sustainable.

Emma, 33, Stockholm, SE

Busy mum Emma enjoys shopping and sees it as a release from everyday life. She shops often and browses fashion apps a couple of times a week.

Finbar, 23, London, UK

Functionality usually triggers Finbar’s need to shop (if he feels cold, he buys a hoodie). He is conscious of consumption and sustainability, but rarely lets it affect his shopping.

Maximilian, 19, Berlin, DE

Maximilian’s style is heavily influenced by his friendship group. He actively avoids “the hippie movement” but hangs on to his clothes for a long time and chooses not to take a plastic bag when he shops. He sees this as “acceptable sustainability.”

Deborah, 24, Lund, SE

Deborah tries to limit her shopping to the sales and sees buying clothes as a luxury — she often splurges on many outfits at once. Unless she actively notices something unethical, it is easy for her to disassociate from the environmental and social impacts of the industry.

Egor, 22, Stockholm, SE

Egor shops for functionality. He thinks it is important to dispose of his clothing in a responsible way and donates to charity or redeploys old items as rags.

Matilda, 24, Hamburg, DE

Our most sustainability-conscious participant, Matilda has committed to not buying any new clothes for a whole year. Even her wedding dress was second-hand.

Marcus, 34, Manchester, UK

Marcus often shops impulsively, but quality is important to him and he is willing to pay substantially more for it.

Raine, 29, London, UK

Fit, material and sustainability are extremely important to Raine and she often asks herself: “Do I really need this stuff?”

Acknowledgements

We would like to thank the survey participants for their contribution to the research as well as the report partners for sharing their perspectives and ideas during interviews. Our thanks go to: adidas, Centre for Sustainable Fashion (London College of Fashion), Filippa K, Global Fashion Agenda, H&M Group, McKinsey & Company, and the Sustainable Apparel Coalition. We would also like to thank C Space, Krukow Behavioral Design and Ogilvy for their collaboration on the report research. Particular thanks go to the team of Given Agency, who helped bring this project to life.